YATU - Your Trusted Loan Partner!

YATU is a premier loan platform for the Zambian market, providing quick, secure, and convenient loan services to help you meet your financial goals. Whether you need short-term funds or long-term financing, YATU is here for you.

Start HereLow Interest Rates

Enjoy competitive rates that make repayment easier.

Flexible Terms

Access both short-term and long-term loan options to suit your needs.

Expert Team

Benefit from the guidance of our experienced financial professionals.

Unsecured Loans

Accessibility: Easier to obtain for those with limited credit history.

Fast Processing: Quick approval and disbursement.

Flexible Terms: More manageable repayment options.

Support for Small Businesses: Essential capital for growth and sustainability.

Secured Loans

Lower Interest Rates: Secured by collateral, these loans generally offer lower interest rates.

Higher Borrowing Amounts: They allow for larger loan amounts compared to unsecured loans.

Extended Repayment Terms: These loans often come with longer repayment periods.

Credit Building: Timely payments can significantly improve your credit score.

Fast

Our loan products offer quick approval and disbursement, ensuring you receive the funds you need in the shortest time possible. Whether for urgent expenses or significant investments, we respond promptly to your requirements.

Security

We employ advanced encryption technologies to ensure the highest level of protection for your personal information and transaction data. Our commitment is to provide a secure and trustworthy lending environment for every customer.

Professionalism

Our team comprises experienced financial experts dedicated to offering you the most professional loan advice and tailored solutions. We strive to deliver personalized loan services to help you achieve your financial goals.

Sign up

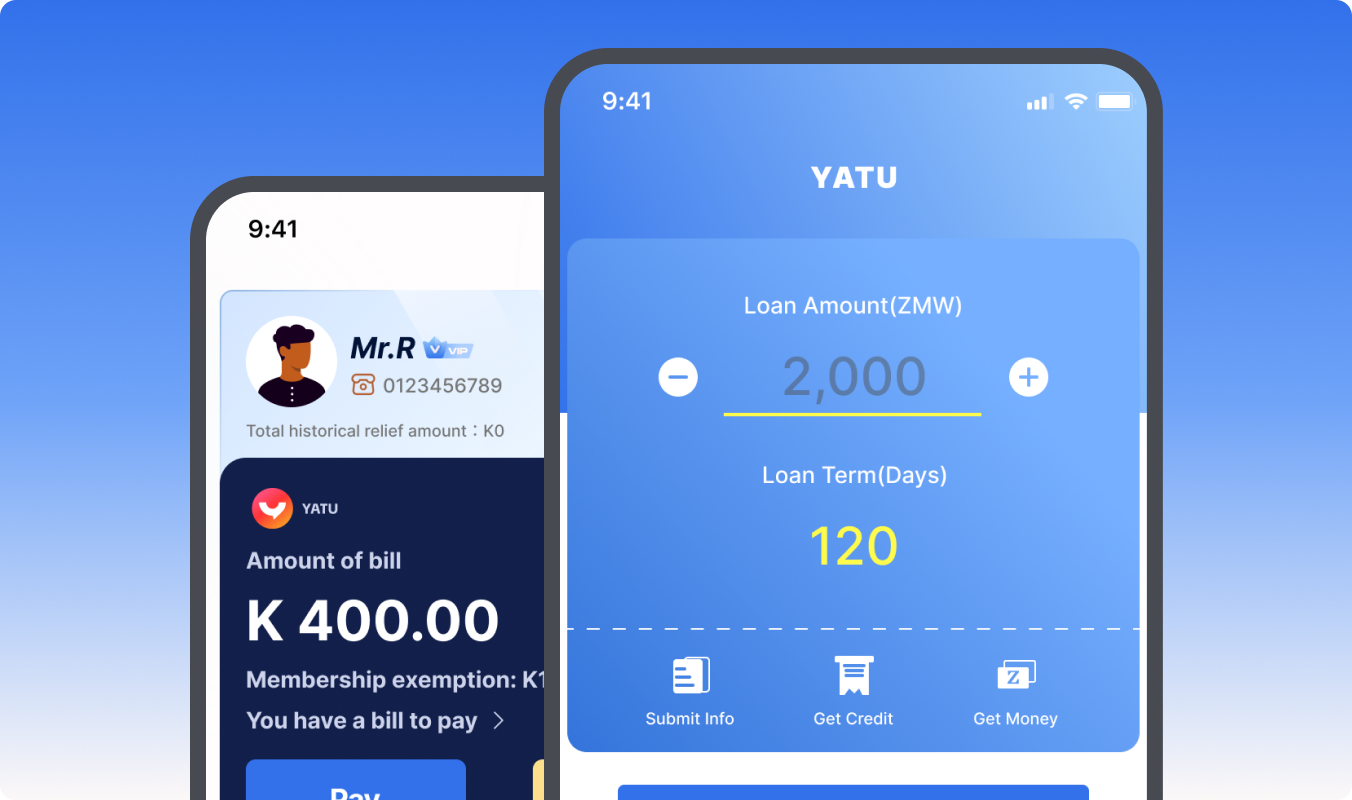

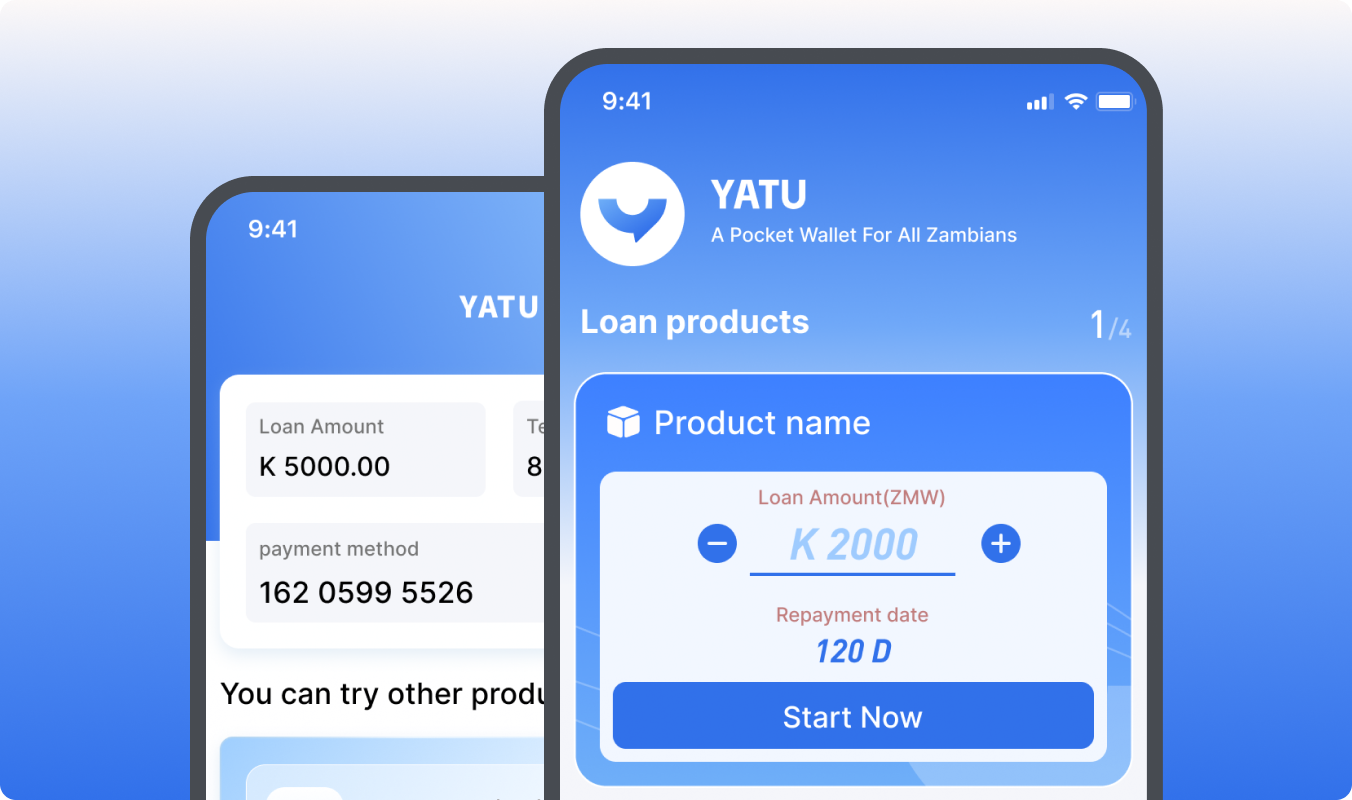

YATU is a user-friendly mobile app designed to provide quick and accessible microloans to individuals in Zambia. The app simplifies the process of obtaining and managing loans, ensuring users can easily access funds when needed.

Products and Service

Advanced Credit System

Intelligent Risk Control Engine

Customized Service Solutions

Compliance and Security

Our platform integrates the latest fintech, providing a user-friendly interface, robust data processing capabilities, and flexible product configuration features to ensure your lending operations are efficient, secure, and convenient.

By combining big data analysis with machine learning technologies, our risk control engine can accurately assess borrower creditworthiness and monitor transaction risks in real-time, significantly reducing the rate of non-performing loans.

Recognizing each client's unique needs, we offer personalized services including system custom development, risk control model training, and data analysis consulting to help your business stand out.

Adhering to strict data protection regulations, we employ industry-leading encryption technology and multiple security measures to ensure the safety and privacy of customer data.

Our Advantages

The following three important reasons are described below.

The best service provider